Invest Like A Scientist

Invest Like A Scientist

A culture of academic inquiry has been Endeavor's bedrock from the start. Our firm is driven by an evidence-based approach, Nobel Prize-winning insights, and decades of expertise pursuing higher returns while maintaining low costs and diversification. As such we use funds from leaders in the investment industry like Dimensional and Vanguard.

THE ENDEAVOR DIFFERENCE

Guided by Financial Science, Not Speculation

Guided by Financial Science, Not Speculation

Our investment process reflects years of innovation and refinement, and this has translated into better returns for investors.

Endeavor

Equity and fixed income funds from Dimensional that outperformed benchmarks over 20 years.

THE INDUSTRY

Equity and fixed income funds that outperformed benchmarks over 20 years

Past performance is no guarantee of future results.*

ENDEAVOR INVESTING

Implementing Great Ideas in Finance

#EvidenceOverEmotion

#MarketBeatingMyth

#LowerFeesHigherReturns

The "Traditional" Approach Approach AKA Crystal Ball Method

The evidence is clear: trying to "beat" the market is a losing game. Yet, many investment advisors build their business around convincing clients they have a secret formula or magic solution. This often leads to unnecessary complexity and frequent account changes, making the advisor appear more sophisticated than they really are. Unfortunately, clients pay the price through higher fees, transaction costs, and taxes.

As Steve Forbes said, "You make more money selling advice than following it." While much of the financial industry focuses on selling products and gathering assets, we believe there’s a better way—one that prioritizes transparency, simplicity, and real results for clients.

Market Myths Debunked: Beating the market isn't just improbable—it's a costly illusion. Our approach removes the smoke and mirrors, delivering strategies rooted in transparency and evidence.

Simpler, Smarter, Better: Complexity in investing often serves advisors, not clients. We focus on keeping costs low, taxes minimized, and your goals at the forefront—no magic tricks required.

Aligned for Your Success: Instead of chasing impossible outcomes, we embrace proven principles to grow your wealth sustainably, aligning our success with yours every step of the way.

#NobelPrizeWinningResearch

#AcademicPrinciplesofInvesting

An Alternate Approach

Fortunately, there’s a smarter approach backed by decades of academic research. It starts with understanding how capital markets work. Investing isn’t a zero-sum game where one investor’s gain means another’s loss. Over time, markets reward investors for taking risks and providing capital.

Markets also process new information incredibly quickly. Current prices reflect the collective knowledge and expectations of all investors. While prices may not always be "perfect," the competition in markets makes it unlikely that any one investor can consistently outsmart everyone else. In short, there’s no free lunch—the only way to aim for higher returns is by taking on more risk.

This approach—based on extensive scholarship and Nobel Prize-winning investing science—eliminates the myths of stock-picking and market-timing from portfolio management.

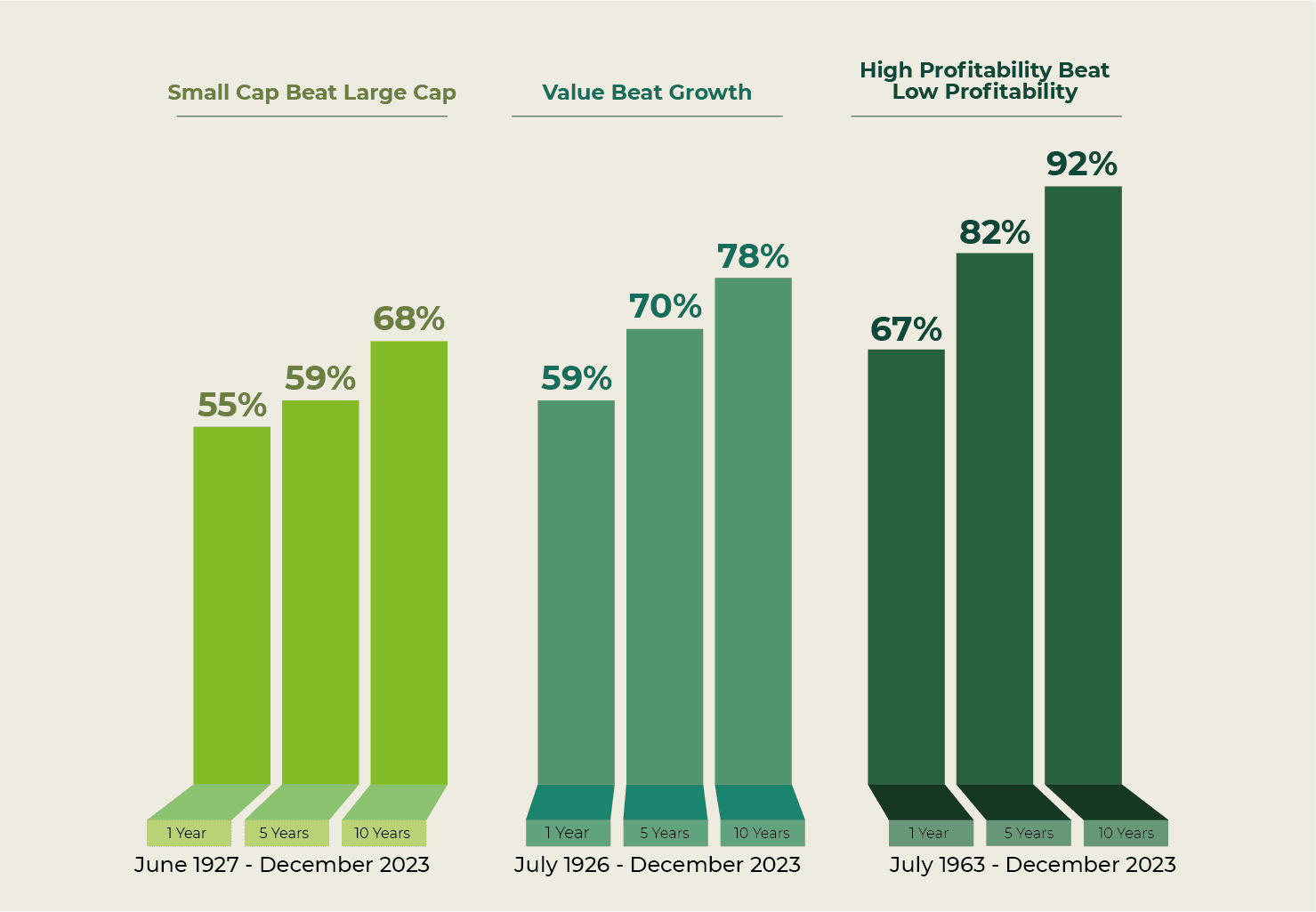

In particular, we integrate Modern Portfolio Theory, the Three Factor Model, and Efficient Market Hypothesis into portfolios designed and engineered to capture market returns.

Investing free from gambling and speculation

#InvestWithPurpose

#ControlWhatMatters

#DiversifyWisely

Our Focus

With this foundation, we shift focus from the losing game of trying to outguess the market to the things we can truly control:

Understanding each client’s unique needs, goals, risk tolerance, and attitudes.

Diversifying broadly across asset classes while minimizing expenses and taxes.

Providing ongoing perspective and discipline to stay on track.

This approach helps clients capture their share of market returns and gives them the best chance of reaching their goals.

Create an Investment plan that fits your needs and risk tolerance

Structure your portfolio using academic science around dimensions of returns.

Optimal portfolios by diversifying, reducing expenses, and miniizes taxes.

#TaxEfficientInvesting

#academicresearch

#DisciplinedApproach

Access to Dimensional Funds (DFA)

Dimensional Fund Advisors (DFA) is one of the primary mutual fund companies we utilize in client accounts. DFA funds are built using the same academic research we rely on to develop our investment philosophy, and as such, they make a perfect partner.

If you aren’t familiar with DFA, here are five reasons you should get to know them (see our blog post for more details):

Their strategies are developed using academic research and their funds have a long track record of outperforming

They have a thoughtful implementation process that adds value to investors.

They only work with advisors who understand the research and have a disciplined approach

Their funds have some of the lowest expenses in the industry

ENDEAVOR INVESTING

Implementing Great Ideas in Finance

#EvidenceOverEmotion

#MarketBeatingMyth

#LowerFeesHigherReturns

The "Traditional" Approach Approach AKA Crystal Ball Method

The evidence is clear: trying to "beat" the market is a losing game. Yet, many investment advisors build their business around convincing clients they have a secret formula or magic solution. This often leads to unnecessary complexity and frequent account changes, making the advisor appear more sophisticated than they really are. Unfortunately, clients pay the price through higher fees, transaction costs, and taxes.

As Steve Forbes said, "You make more money selling advice than following it." While much of the financial industry focuses on selling products and gathering assets, we believe there’s a better way—one that prioritizes transparency, simplicity, and real results for clients.

Market Myths Debunked: Beating the market isn't just improbable—it's a costly illusion. Our approach removes the smoke and mirrors, delivering strategies rooted in transparency and evidence.

Simpler, Smarter, Better: Complexity in investing often serves advisors, not clients. We focus on keeping costs low, taxes minimized, and your goals at the forefront—no magic tricks required.

Aligned for Your Success: Instead of chasing impossible outcomes, we embrace proven principles to grow your wealth sustainably, aligning our success with yours every step of the way.

#NobelPrizeWinningResearch

#AcademicPrinciplesofInvesting

An Alternate Approach

Fortunately, there’s a smarter approach backed by decades of academic research. It starts with understanding how capital markets work. Investing isn’t a zero-sum game where one investor’s gain means another’s loss. Over time, markets reward investors for taking risks and providing capital.

Markets also process new information incredibly quickly. Current prices reflect the collective knowledge and expectations of all investors. While prices may not always be "perfect," the competition in markets makes it unlikely that any one investor can consistently outsmart everyone else. In short, there’s no free lunch—the only way to aim for higher returns is by taking on more risk.

This approach—based on extensive scholarship and Nobel Prize-winning investing science—eliminates the myths of stock-picking and market-timing from portfolio management.

In particular, we integrate Modern Portfolio Theory, the Three Factor Model, and Efficient Market Hypothesis into portfolios designed and engineered to capture market returns.

Investing free from gambling and speculation

#InvestWithPurpose

#ControlWhatMatters

#DiversifyWisely

Our Focus

With this foundation, we shift focus from the losing game of trying to outguess the market to the things we can truly control:

Understanding each client’s unique needs, goals, risk tolerance, and attitudes.

Diversifying broadly across asset classes while minimizing expenses and taxes.

Providing ongoing perspective and discipline to stay on track.

This approach helps clients capture their share of market returns and gives them the best chance of reaching their goals.

Create an Investment plan that fits your needs and risk tolerance

Structure your portfolio using academic science around dimensions of returns.

Optimal portfolios by diversifying, reducing expenses, and miniizes taxes.

#TaxEfficientInvesting

#academicresearch

#DisciplinedApproach

Access to Dimensional Funds (DFA)

Dimensional Fund Advisors (DFA) is one of the primary mutual fund companies we utilize in client accounts. DFA funds are built using the same academic research we rely on to develop our investment philosophy, and as such, they make a perfect partner.

If you aren’t familiar with DFA, here are five reasons you should get to know them (see our blog post for more details):

Their strategies are developed using academic research and their funds have a long track record of outperforming

They have a thoughtful implementation process that adds value to investors.

They only work with advisors who understand the research and have a disciplined approach

Their funds have some of the lowest expenses in the industry

ENDEAVOR INVESTING

Implementing Great Ideas in Finance

#EvidenceOverEmotion

#MarketBeatingMyth

#LowerFeesHigherReturns

The "Traditional" Approach Approach AKA Crystal Ball Method

The evidence is clear: trying to "beat" the market is a losing game. Yet, many investment advisors build their business around convincing clients they have a secret formula or magic solution. This often leads to unnecessary complexity and frequent account changes, making the advisor appear more sophisticated than they really are. Unfortunately, clients pay the price through higher fees, transaction costs, and taxes.

As Steve Forbes said, "You make more money selling advice than following it." While much of the financial industry focuses on selling products and gathering assets, we believe there’s a better way—one that prioritizes transparency, simplicity, and real results for clients.

Market Myths Debunked: Beating the market isn't just improbable—it's a costly illusion. Our approach removes the smoke and mirrors, delivering strategies rooted in transparency and evidence.

Simpler, Smarter, Better: Complexity in investing often serves advisors, not clients. We focus on keeping costs low, taxes minimized, and your goals at the forefront—no magic tricks required.

Aligned for Your Success: Instead of chasing impossible outcomes, we embrace proven principles to grow your wealth sustainably, aligning our success with yours every step of the way.

#NobelPrizeWinningResearch

#AcademicPrinciplesofInvesting

An Alternate Approach

Fortunately, there’s a smarter approach backed by decades of academic research. It starts with understanding how capital markets work. Investing isn’t a zero-sum game where one investor’s gain means another’s loss. Over time, markets reward investors for taking risks and providing capital.

Markets also process new information incredibly quickly. Current prices reflect the collective knowledge and expectations of all investors. While prices may not always be "perfect," the competition in markets makes it unlikely that any one investor can consistently outsmart everyone else. In short, there’s no free lunch—the only way to aim for higher returns is by taking on more risk.

This approach—based on extensive scholarship and Nobel Prize-winning investing science—eliminates the myths of stock-picking and market-timing from portfolio management.

In particular, we integrate Modern Portfolio Theory, the Three Factor Model, and Efficient Market Hypothesis into portfolios designed and engineered to capture market returns.

Investing free from gambling and speculation

#InvestWithPurpose

#ControlWhatMatters

#DiversifyWisely

Our Focus

With this foundation, we shift focus from the losing game of trying to outguess the market to the things we can truly control:

Understanding each client’s unique needs, goals, risk tolerance, and attitudes.

Diversifying broadly across asset classes while minimizing expenses and taxes.

Providing ongoing perspective and discipline to stay on track.

This approach helps clients capture their share of market returns and gives them the best chance of reaching their goals.

Create an Investment plan that fits your needs and risk tolerance

Structure your portfolio using academic science around dimensions of returns.

Optimal portfolios by diversifying, reducing expenses, and miniizes taxes.

#TaxEfficientInvesting

#academicresearch

#DisciplinedApproach

Access to Dimensional Funds (DFA)

Dimensional Fund Advisors (DFA) is one of the primary mutual fund companies we utilize in client accounts. DFA funds are built using the same academic research we rely on to develop our investment philosophy, and as such, they make a perfect partner.

If you aren’t familiar with DFA, here are five reasons you should get to know them (see our blog post for more details):

Their strategies are developed using academic research and their funds have a long track record of outperforming

They have a thoughtful implementation process that adds value to investors.

They only work with advisors who understand the research and have a disciplined approach

Their funds have some of the lowest expenses in the industry

The Best of Both Passive/Active Investment

The Best of Both Passive/Active Investment

Cutting-Edge Application of Financial Science

Cutting-Edge Application of Financial Science

Our Inspiration

Our Inspiration

Endeavors investment approach is grounded in economic theory and backed by decades of empirical data. Our ongoing research to understand what drives returns and to uncover insights that are useful moving forward fuels innovation at the firm.

We hold research to a high standard and only act on findings we firmly believe can benefit investors. These are the Nobel Prize Winning scientists who designed the theories and empirical research behind our portfolios.

Merton Miller

Nobel laureate, 1990

Miller, along with Harry Markowitz and William Sharpe, wins the Nobel Prize for his pioneering work in the theory of financial economics.

Robert Merton

Nobel laureate, 1997

Merton, along with Myron Scholes and Fischer Black, receives a Nobel Prize for developing a new method to determine the value of derivatives.

Myron Scholes

Nobel laureate, 1997

Scholes, along with Robert Merton and Fischer Black, is awarded a Nobel Prize for developing a new method to determine the value of derivatives.

Eugene Fama

Nobel laureate, 2013

Fama wins the Nobel Prize for his empirical analysis of asset prices.

FAQ

Your Questions, Answered

What types of people does Endeavor work with?

We work with individuals from all walks of life. However, to remain sustainable as a business, we must receive fair compensation. Our ideal clients are those who have achieved a certain level of success, typically with a portfolio of at least $250,000. They’ve done an excellent job of saving and now seek expert guidance to optimize their wealth without the burden of managing it all themselves. If we’re unable to work together, we will gladly assist with any questions you have and direct you to someone who can help. Please feel free to reach out today to explore what’s possible.

What fees can I expect?

We work with people looking to delegate their critical planning and investment needs on an ongoing basis. For clients with investable assets of $350,000 or more, fees are calculated as a percentage of those assets —1% on the first $1,000,000 we manage —0.75% between $1,000,000 and $5,000,000 —0.50% between $5,000,000 and $10,000,000 For clients with less than $350,000 in investable assets, We also charge a $300/month financial planning fee. That covers everything else we do together — budgeting, tax planning, insurance reviews, goal-setting, you name it. Once your investments with us reach $350,000, we drop the $300/month planning fee. We don’t get paid through any type of commission, kickback, or other undisclosed revenue sources.

What services do you offer?

Our mission is to maximize the value you get from your money. To achieve this, we aim to handle as much of the planning for you as possible. We assist clients with: Retirement planning Investment management Tax planning Estate planning Insurance review Cash flow planning And everything else necessary to ensure you feel both secure and enthusiastic about your financial future!

Can you help with proactive tax planning?

Your CPA does a great job accounting for last year's financials, but they often don't focus on minimizing your future tax liability. At Endeavor Advisors, we provide a comprehensive view and offer strategies to optimize your spending and savings for tax efficiency. You, or your CPA, will still handle filing your tax return.

What types of people does Endeavor work with?

We work with individuals from all walks of life. However, to remain sustainable as a business, we must receive fair compensation. Our ideal clients are those who have achieved a certain level of success, typically with a portfolio of at least $250,000. They’ve done an excellent job of saving and now seek expert guidance to optimize their wealth without the burden of managing it all themselves. If we’re unable to work together, we will gladly assist with any questions you have and direct you to someone who can help. Please feel free to reach out today to explore what’s possible.

What fees can I expect?

We work with people looking to delegate their critical planning and investment needs on an ongoing basis. For clients with investable assets of $350,000 or more, fees are calculated as a percentage of those assets —1% on the first $1,000,000 we manage —0.75% between $1,000,000 and $5,000,000 —0.50% between $5,000,000 and $10,000,000 For clients with less than $350,000 in investable assets, We also charge a $300/month financial planning fee. That covers everything else we do together — budgeting, tax planning, insurance reviews, goal-setting, you name it. Once your investments with us reach $350,000, we drop the $300/month planning fee. We don’t get paid through any type of commission, kickback, or other undisclosed revenue sources.

What services do you offer?

Our mission is to maximize the value you get from your money. To achieve this, we aim to handle as much of the planning for you as possible. We assist clients with: Retirement planning Investment management Tax planning Estate planning Insurance review Cash flow planning And everything else necessary to ensure you feel both secure and enthusiastic about your financial future!

Can you help with proactive tax planning?

Your CPA does a great job accounting for last year's financials, but they often don't focus on minimizing your future tax liability. At Endeavor Advisors, we provide a comprehensive view and offer strategies to optimize your spending and savings for tax efficiency. You, or your CPA, will still handle filing your tax return.

Let's Talk

See how we can help you live your best life in retirement

2801 E Camelback Rd,

Suite 202

Phoenix, AZ 85016

25 S Arizona Pl

5th Floor,

Chandler, AZ 85225

3655 Torrance Blvd

3rd floor,

Torrance, CA 90503

Let's Talk

See how we can help you live your best life in retirement

2801 E Camelback Rd,

Suite 202

Phoenix, AZ 85016

25 S Arizona Pl

5th Floor,

Chandler, AZ 85225

3655 Torrance Blvd

3rd floor,

Torrance, CA 90503

Let's Talk

See how we can help you live your best life in retirement

2801 E Camelback Rd,

Suite 202

Phoenix, AZ 85016

25 S Arizona Pl

5th Floor,

Chandler, AZ 85225

3655 Torrance Blvd

3rd floor,

Torrance, CA 90503